Gas Prices Explained Five Fast Facts About U.S. Gasoline Prices

1.Petroleum prices are determined by market forces of supply and demand, not individual companies, and the price of crude oil is the primary determinant of the price we pay at the pump. Oil prices are at a seven-year high amid a persistent global supply crunch, workforce constraints, increasing geopolitical instability in Eastern Europe, the economic rebound following the initial stages of the pandemic, and policy uncertainty from Washington.

2.Policy choices matter. American producers are working to meet rising energy demand as supply continues to lag, but policy and legal uncertainty is complicating market challenges.

3.The administration needs an energy-policy reset, and Europe is a cautionary tale. We need not look further than the situation in Europe to see what happens when nations depend on energy production from foreign sources that have agendas of their own. There is more policymakers could do to ensure access to affordable, reliable energy, starting with incentivizing U.S. production and energy infrastructure and sending a clear message that America is open for energy investment.

4.Repeated in-depth investigations by the FTC have shown that changes in gasoline prices are based on market factors and not due to illegal behavior, and the American people are looking for solutions, not finger pointing. The price at the pump that Americans are currently paying is a function of increased demand and lagging supply combined with the geopolitical turmoil resulting from Russia’s aggression in Ukraine.

5.Lawmakers should focus on policies that increase U.S. supply to help mitigate the situation rather than political grandstanding that does nothing but discourage investment at a time when it’s needed the most.

What Determines the Cost of Crude Oil?

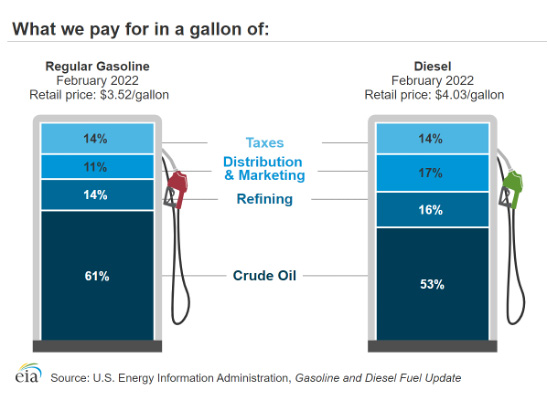

The cost of crude oil is the largest factor in the retail price of gasoline. Because of this, changes in the retail price of gasoline typically track changes in the global crude oil price. Crude oil prices are impacted by geopolitics, global market fundamentals, including supply and demand, inventories, seasonality, financial market considerations and expectations.

Taxes Add to the Price of Gasoline.

Federal, state, and local government taxes also contribute to the retail price of gasoline. The federal excise tax is 18.40¢ per gallon (cpg), and state gasoline fees and taxes range from a low of about 15 cpg in Alaska to as much as 68 cpg in California and around 59 cpg in Illinois and Pennsylvania. On average, state taxes and fees average about 39 cpg and when combined with federal taxes average 57 cpg at the pump. Sales taxes along with taxes applied by local and municipal governments also can add to gasoline prices in some locations.

Refining Costs

In addition to purchasing the crude oil, the refinery incurs costs associated with processing the crude through the refinery to produce gasoline, diesel and other petroleum products. Refining costs vary seasonally (e.g., higher production costs for summer blend vs. non-summer gasoline blends) and by region of the United States, partly because of the different gasoline formulations required to reduce air emissions in different parts of the country. In addition, as more people drive in the summer, there is increased demand for gasoline generally resulting in upward pressure on prices. Gasoline prices are also affected by the cost of other components that may be blended into the gasoline, such as ethanol.

Distribution and Marketing

Distribution and marketing costs are also included in the retail price of gasoline. Distribution and delivery costs of gasoline can include pipeline, marine, truck, and rail costs associated with moving the gasoline from the refinery to the terminal. From the terminal, gasoline is delivered by tanker truck to individual gasoline stations. Marketing costs are incurred to support the sale of gasoline by the refineries, distributors and wholesalers and the retailer.